PPA Solar Pros and Cons: Complete Guide to Solar Power Purchase Agreements

Solar energy adoption continues to surge across the United States, but the hefty upfront costs of $15,000 to $50,000 keep many homeowners from installing solar panels on their properties. This financial barrier has led to the rise of solar power purchase agreements (PPAs) - a financing option that promises immediate access to clean energy with zero down payment.

Under a solar PPA, you’ll receive a monthly bill based on your system’s actual energy production multiplied by a predetermined rate, typically 20-60% below your local utility company rates. For example, if your solar power system generates 800 kWh in September at a rate of $0.20 per kilowatt-hour, you’ll pay $160 that month. However, if cloudy weather reduces production to 600 kWh, your bill drops to $120. While lower bills are generally preferable, in this case, a higher bill indicates your system produced more electricity at cheaper rates than the utility charges you.

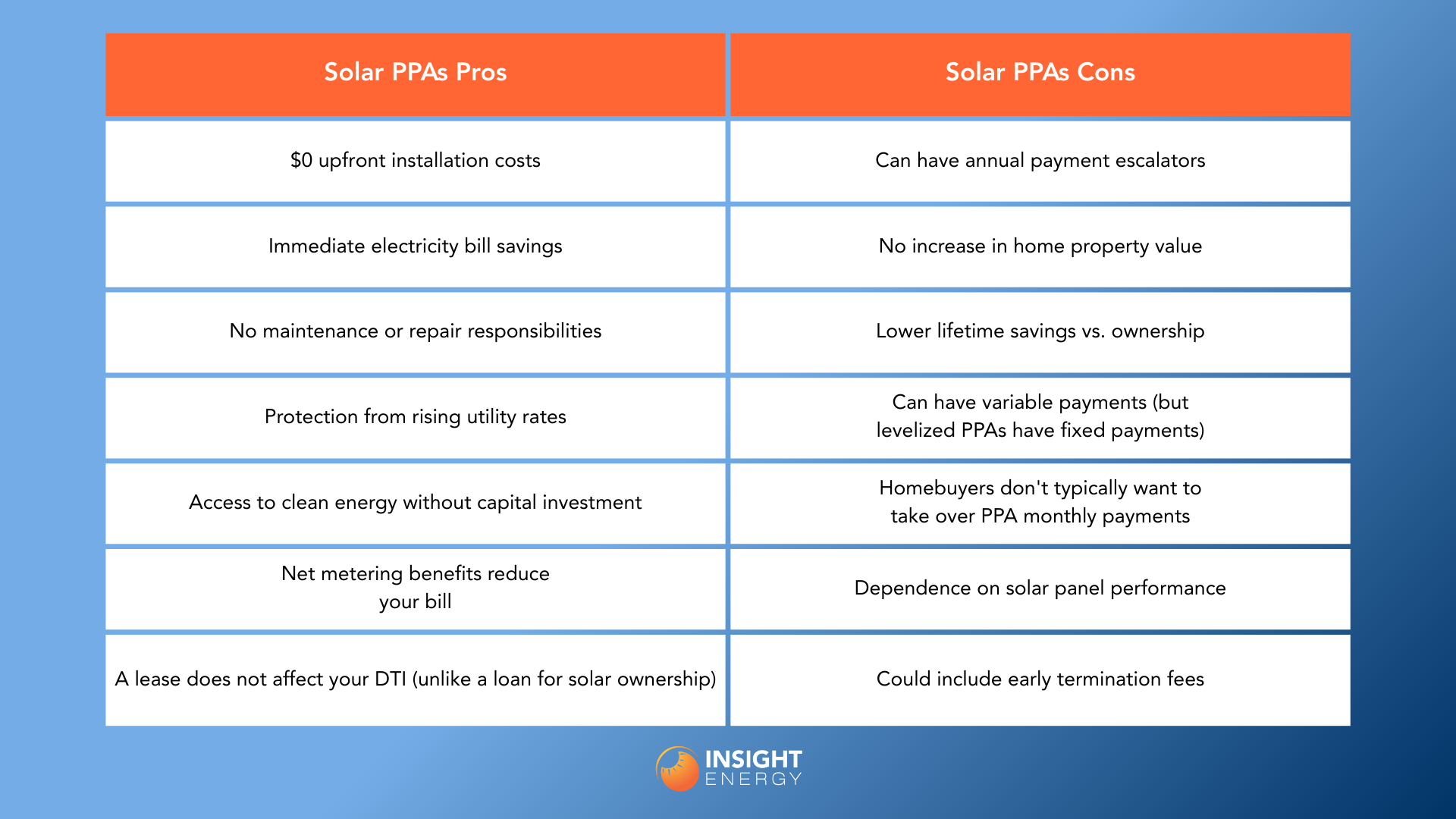

Solar PPA Pros and Cons at a Glance

Before diving deep into the details, here’s a quick overview of the key advantages and disadvantages of solar power purchase agreements:

Key Commitment: Solar PPAs typically require a 20-25 year contract commitment, making it essential to understand all implications before proceeding.

What is a Solar Power Purchase Agreement?

A solar power purchase agreement is a financial agreement in which a third-party solar company installs, and a PPA provider owns and maintains a solar panel system on your property. Instead of buying solar panels outright, you agree to purchase the electricity the system produces at a predetermined rate per kilowatt-hour (kWh).

Here’s how the basic structure works:

Contract Length: Typically 15-25 years, with most agreements lasting 20-25 years

Rate Structure: You pay per kWh of electricity generated, usually 20-60% below your current utility rates

System Ownership: The PPA provider retains ownership of the entire solar energy system throughout the contract period

Monthly Billing: You receive a separate monthly PPA payment based on actual system production, which varies seasonally

Solar PPAs are popular in Massachusetts and Connecticut, where high electricity rates and strong state incentives make them especially cost‑effective. The monthly billing process is straightforward - you pay your PPA provider for the power generated by your solar system, while still maintaining your connection to the utility company for any additional electricity needs.

Solar PPA Advantages

Zero Upfront Investment

The most compelling advantage of solar PPAs is eliminating the substantial upfront costs associated with installing solar panels. While buying solar panels typically costs between $15,000 and $50,000, PPAs require no initial investment from homeowners.

This accessibility makes solar energy available to households who couldn’t otherwise afford the upfront investment, including those with limited savings, poor credit, or insufficient taxable income to benefit from ownership.

Immediate Electricity Bill Savings

Solar PPA customers begin saving on their energy bills from day one of system activation. Average households typically see monthly savings of $15 to $45, depending on system size, local electricity rates, and seasonal production variations.

These immediate savings provide tangible financial benefits without the long payback period associated with buying solar panels. The savings are realized through reduced utility power consumption, as your home uses clean energy generated by the solar panels before drawing from the grid.

Protection Against Rising Utility Rates

Utility companies across the United States have increased electricity rates by an average of 2.67% annually over the past decade. Solar PPAs provide a hedge against these rising costs by locking in a fixed rate for solar power generation.

While many PPA contracts include escalator clauses that increase rates annually, these increases are typically lower than utility rate inflation, providing long-term cost predictability and protection.

Zero Maintenance Responsibility

Under a solar PPA arrangement, the PPA provider maintains complete responsibility for system performance, maintenance, and repairs throughout the contract term. This includes:

Regular system monitoring to ensure optimal performance

Equipment warranties covering panels, inverters, and other components

Repair services for any system malfunctions or damage

Performance guarantees ensuring minimum electricity production levels

This maintenance-free approach eliminates the time, cost, and technical expertise required to maintain a solar power system, making it particularly attractive for homeowners who prefer a hands-off approach to their solar investment.

Net Metering Benefits

When your solar system produces more electricity than your home uses, the excess energy is sent back to the grid through local net metering programs. Under a solar PPA, the PPA provider usually receives the value of these energy credits or Renewable Energy Certificates (RECs). These incentives are factored into the PPA pricing structure, which helps keep your per‑kilowatt‑hour (kWh) rate lower than standard utility rates.

Although homeowners don’t directly receive the net metering credits, they still benefit indirectly through reduced electricity costs and predictable monthly payments. This structure ensures customers get consistent savings while the provider manages and optimizes system performance.

Escalator Clauses and Long‑Term Savings

Most solar PPA contracts include annual escalator clauses that increase the electricity rate by about 1%–3% per year to account for inflation and system performance over time. While this may sound like an added cost, it actually helps maintain project viability while still keeping prices below typical utility rate increases.

In states like Massachusetts and Connecticut, where utility costs have historically risen faster than 3% annually, the escalator often works in the homeowner’s favor. A 2.9% annual escalator, for example, still results in substantial savings during the first half of the contract, and since utility rates often continue to climb, most customers find their savings grow over time rather than shrink.

Access to Professional Installation and Design

Solar companies offering PPAs bring valuable expertise to system design and installation — they handle everything from panel placement and permitting to local code compliance and utility interconnection. However, it’s important to remember that not all installers provide the same level of service once the system is up and running.

In many cases, PPA customers get bounced between the installer and the PPA provider when issues arise, with the installer telling the homeowner to “call the provider first.” That’s why vetting your installer is just as important as choosing the right PPA. Look for a company with a solid reputation for customer support, clear communication, and accountability.

This professional approach often results in better system performance compared to DIY installations, maximizing the electricity generated and the resulting bill savings.

Solar PPA Disadvantages

No Increase in Home Property Value

Multiple studies, including research from the Lawrence Berkeley National Laboratory, have shown that owned solar systems increase property value by approximately 4% on average. However, solar leases and PPAs typically provide no property value increase since the homeowner doesn’t own the system.

This means PPA customers miss out on building equity through their solar investment, while homeowners who purchase their systems see both immediate energy savings and increased home value.

Significantly Lower Lifetime Savings

While solar PPAs deliver immediate savings and remove upfront costs, the total lifetime financial return is generally lower than owning a system outright. Homeowners who buy their solar panels, either with cash or through a solar loan, can typically achieve greater long‑term savings.

The difference comes from several factors: PPA customers continue making payments over the contract term, and the provider retains ownership and a portion of the project’s profit margin. In contrast, system owners can usually recoup their investment within 7–10 years and then enjoy free or nearly free electricity for the remainder of the system’s lifespan, which often extends 25 years or more.

Contract Transfer Complications When Selling

Selling a home with a PPA requires either transferring the contract to the new buyer or exercising early termination options. Both scenarios can complicate real estate transactions:

Buyer qualification: New homeowners must meet the solar company’s credit requirements to assume the contract, which are generally low. If you can get a mortgage, you can qualify for the transfer.

Early termination fees: Depending on your PPA Provider, breaking the contract early can involve substantial penalties. Insight’s PPA provider does not incur these fees.

Buyer resistance: Some potential buyers may be deterred by the long-term contract obligation

Real estate professionals report that PPA-encumbered properties can take longer to sell and may receive lower offers compared to homes with owned solar systems.

Dependence on Third-Party Company Performance

PPA customers depend on the PPA provider for maintenance and billing, but established providers ensure reliability under long‑term contractual service guarantees.

This dependence risk extends to system performance guarantees - if the system underperforms due to equipment failures or inadequate maintenance, customers must rely on the company to address issues promptly and effectively.

Variable Monthly Payments

Unlike solar leases with fixed monthly fees, PPA payments fluctuate based on actual electricity production. This variability can complicate household budgeting, especially during:

Seasonal changes when solar production naturally decreases in winter

Weather variations that affect monthly output

System performance issues that temporarily reduce production

These payment fluctuations make it harder to predict exact monthly energy costs compared to the stable payments offered by solar loans or the predictable absence of payments after a cash purchase pays for itself.

Red Flags to Avoid

When considering a solar PPA, watch for these warning signs that suggest a potentially unfavorable agreement:

“Free Solar” Marketing Claims

Legitimate solar companies never offer truly “free” systems. While PPAs require no upfront payment, homeowners still make monthly payments throughout the contract term. Companies using “free solar” marketing often employ high-pressure sales tactics and may not fully explain contract obligations.

Excessive Escalator Clauses

Annual rate increases above 3% should raise concerns, especially in regions where utility rate growth has been modest. High escalator clauses can eliminate savings in the later years of your contract.

High-Pressure Sales Tactics

Reputable solar providers give customers time to review contracts and compare options. Avoid companies that demand same-day decisions or use fear-based tactics to pressure immediate signing.

Poor Company Reputation

Research potential providers thoroughly by checking Better Business Bureau ratings, online reviews, and state contractor licensing boards. Companies with numerous complaints or recent legal issues pose significant risks over a 20-25 year relationship.

Unclear Contract Terms

PPA agreements should clearly specify early termination procedures, end-of-contract options, and system removal responsibilities. Vague or confusing contract language often hides unfavorable terms.

Solar PPA vs Other Financing Options

Understanding how PPAs compare to other solar financing methods helps clarify whether this option aligns with your financial situation and goals.

Key Differences Explained

Power Purchase Agreement PPA vs Solar Lease: The primary difference lies in payment structure. Solar leases charge a fixed monthly fee regardless of system production, while solar PPAs charge based on actual electricity generated. PPAs offer more transparency about energy costs but create payment variability.

Solar PPA vs Solar Loans: Monthly loan payments are typically fixed and often comparable to PPA costs, but borrowers gain ownership after loan repayment. However, loans require good credit and create personal debt obligations.

Solar PPA vs Cash Purchase: Cash purchases maximize lifetime savings by eliminating monthly financing costs. However, they require substantial upfront investment and transfer all maintenance responsibilities to the homeowner.

When PPAs Make Sense

Despite their limitations, solar PPAs represent the optimal choice for specific situations:

Insufficient Capital for Upfront Investment

Families without $15,000-$50,000 available for solar installation, or who prefer to preserve cash for other financial priorities, benefit from PPA accessibility. This includes young families building emergency funds or those facing other major expenses.

Limited Credit or Less-Than-Ideal Loan Terms

Homeowners with credit scores below 650 may find it difficult to qualify for favorable solar loan terms, even if they technically meet the minimum requirements. Solar PPAs often provide a more accessible path, since their credit standards are generally more flexible and approval is based on payment history rather than strict lending criteria. This makes PPAs a practical option for households that want the benefits of solar without taking on a loan.

Preference for Zero Maintenance Responsibility

Some homeowners prioritize convenience over maximum savings. PPAs eliminate all system maintenance concerns, appealing to busy professionals, elderly homeowners, or those uncomfortable with technical responsibilities.

Short-Term Residence Plans

Homeowners planning to move within 10 years may benefit more from immediate PPA savings than long-term ownership investments. However, they must still consider contract transfer implications during home sales.

Key Contract Terms to Evaluate

Before signing any PPA agreement, carefully review these critical contract elements:

Rate Structure and Escalation

Starting Rate: Compare the initial per-kWh rate to your current utility costs

Escalator Clause: Understand annual increase percentages and cumulative impact

Rate Comparison: Calculate total costs over the contract term versus projected utility expenses

Performance Guarantees and System Sizing

Production Estimates: Review projected annual electricity generation

Performance Guarantees: Understand minimum production commitments and remedies for underperformance

System Size: Ensure the system matches your household’s energy consumption patterns

Early Termination and Buyout Options

Termination Fees: Understand penalties for ending the contract early

Buyout Formulas: Review how early purchase prices are calculated

Transfer Requirements: Know the process for transferring contracts during home sales

End-of-Contract Choices

Renewal Terms: Understand options for extending the agreement

Purchase Price: Review fair market value calculations for end-of-term purchases

Removal Responsibilities: Clarify who pays for system removal if you choose not to keep it

Insurance and Liability Coverage

Property Insurance: Confirm how the system affects your homeowner’s insurance

Liability Coverage: Understand responsibility for system-related property damage

Performance Insurance: Verify the company’s insurance against system failures

Home Sale Transfer Criteria

Buyer Qualifications: Know credit and income requirements for contract assumption

Transfer Fees: Understand any costs associated with contract transfers

Alternative Options: Review backup plans if buyers cannot qualify for assumption

End-of-Contract Options

As your 20-25 year PPA approaches its conclusion, you’ll typically face three primary options that significantly impact your continued solar experience and costs:

System Purchase at Fair Market Value

Most PPA contracts include provisions allowing you to purchase the system at its fair market value during the final contract year, depending on system size and condition.

Considerations for purchase:

Remaining system life: Solar panels typically retain 80-85% efficiency after 25 years and can continue producing electricity for several more decades

Technology improvements: Newer panels and inverters may offer better performance, but existing systems often provide continued value

Cost comparison: Compare purchase costs against new system installation or continued utility reliance

Contract Renewal for Additional Terms

Many solar companies offer contract renewals for additional 5-10 year periods, typically at reduced rates reflecting the system’s depreciated value. These extensions allow continued access to solar power without the upfront purchase cost.

Renewal considerations:

Rate negotiations: Use the system’s age and market conditions to negotiate favorable renewal rates

Performance expectations: Understand how system aging may affect electricity production

Alternative options: Compare renewal costs against new system installation with current technology

Free System Removal

If you choose not to purchase or renew, most PPA contracts require the company to remove the system at no cost to the homeowner. This option returns your property to its original condition but eliminates ongoing solar benefits.

Removal implications:

Property restoration: Ensure the contract specifies complete roof restoration and repair of any installation damage

Timeline requirements: Understand how quickly removal must occur after contract expiration

Cost verification: Confirm that removal costs don’t become your responsibility under any circumstances

Planning Ahead for Contract End

Smart PPA customers begin evaluating their options 2-3 years before contract expiration:

System performance assessment: Monitor production trends to understand current system value

Technology comparison: Research current solar technology improvements and costs

Financial analysis: Calculate the economics of each option based on your current situation

Market research: Get quotes for new system installation to compare against purchase or renewal options

Is a Solar PPA Right for You?

Determining whether a solar power purchase agreement aligns with your financial situation and energy goals requires honest assessment of several key factors:

Financial Situation Assessment

Available Capital and Credit:

Assess whether you have $15,000-$50,000 available for solar installation without compromising emergency funds

Check your credit score and research solar loan options before committing to a PPA

Consider whether preserving cash for other investments or expenses takes priority over maximum solar savings

Remember that debt‑to‑income ratio is a major factor in loan approval. Some would argue (and we agree) that if paying cash isn’t an option, it’s often smarter to choose a solar lease or PPA rather than taking on additional debt.

Long-term Financial Goals:

Evaluate whether building home equity through solar ownership aligns with your wealth-building strategy

Consider how the 20-25 year commitment fits with your other financial plans or how comfortable you are with the transfer process

Assess whether immediate savings or long-term wealth accumulation takes priority

Lifestyle and Housing Considerations

Residence Timeline:

Consider how long you plan to remain in your current home

Understand the complexity of transferring PPA contracts during home sales

Evaluate whether short-term savings outweigh potential real estate complications

Maintenance Preferences:

Honestly assess your comfort level with system monitoring and maintenance responsibilities

Consider whether convenience justifies accepting lower long-term financial returns

Evaluate your technical knowledge and willingness to manage solar system performance

Questions to Ask Before Signing

Before committing to any solar PPA, ask yourself and potential providers these essential questions:

Financial Questions:

What are my total projected costs over the full contract term, including escalations?

How do these costs compare to current utility projections over the same period?

What are the exact penalties and costs for early termination?

How will the contract affect my home’s sale value and marketability?

Performance Questions:

What specific production guarantees does the company provide?

How quickly will performance issues be addressed?

What happens if the company experiences financial difficulties or changes ownership?

Contract Questions:

What are my exact options at contract expiration?

How are fair market values calculated for end-of-term purchases?

What fees are associated with contract transfers during home sales?

Our Recommendation: Consider Ownership First

While solar PPAs serve important accessibility functions, we recommend exploring solar ownership options, such as cash purchases or solar loans, first for most homeowners.

If you have cash on hand or access to a home equity line of credit (HELOC), ownership is typically the best route. With a HELOC, you may even be able to deduct the interest, adding another layer of financial benefit. Ownership allows you to capture the full value of incentives, increase property value, and enjoy free electricity once the system is paid off.

Here’s why ownership often makes sense:

Ownership benefits, including property value increases

Comparable monthly payments to PPAs during the loan term

Complete elimination of payments after loan completion

Greater long-term financial benefits

However, if taking on new debt would negatively affect your debt-to-income (DTI) ratio, a solar lease or PPA can be the smarter move. The benefit of not having a DTI hit, combined with no upfront cost and no maintenance responsibility, makes PPAs or leases ideal for homeowners who want immediate savings and simplicity without adding financial strain.

PPAs make the most sense when:

You lack access to attractive solar loan terms

You have no available capital and strong preference for zero maintenance responsibility

You plan to move within 10 years and prioritize immediate savings over long-term wealth building

Making the Final Decision

The choice between solar financing options ultimately depends on balancing immediate accessibility against long-term financial optimization. PPAs excel at providing immediate solar access to households who cannot otherwise participate in the solar transition, while ownership options maximize financial benefits for those who can navigate the upfront investment and ongoing responsibilities.

Whatever option you choose, ensure you fully understand the 20-25 year commitment you’re making and feel confident that the agreement aligns with your financial goals and lifestyle preferences. Take time to review contracts carefully, ask questions about unclear terms, and consider consulting with financial and legal professionals for complex situations.

Solar energy represents a powerful tool for reducing electricity costs and environmental impact. By understanding the solar PPA pros and cons outlined in this guide, you can make an informed decision that serves your household’s needs while contributing to the broader transition toward clean energy.

Remember that the solar industry continues evolving rapidly, with new financing options, improved technology, and changing policies regularly emerging. Stay informed about developments that might affect your solar investment, and don’t hesitate to reassess your options as circumstances change over your contract term.

The path to solar energy doesn’t have to be complicated, but it does require careful consideration of your unique situation and goals. Whether you choose a PPA, loan, lease, or cash purchase, the most important step is taking action toward cleaner, more predictable energy costs for your home.